Essentials of corporate finance stephen ross pdf – Delving into the Essentials of Corporate Finance: A Comprehensive Guide to Financial Management by Stephen Ross [PDF], this introduction immerses readers in a unique and compelling narrative, with an authoritative tone that is both engaging and thought-provoking from the very first sentence.

Exploring the intricacies of corporate finance, this comprehensive guide provides a thorough understanding of the essential principles, strategies, and practices that drive successful financial management in today’s dynamic business landscape.

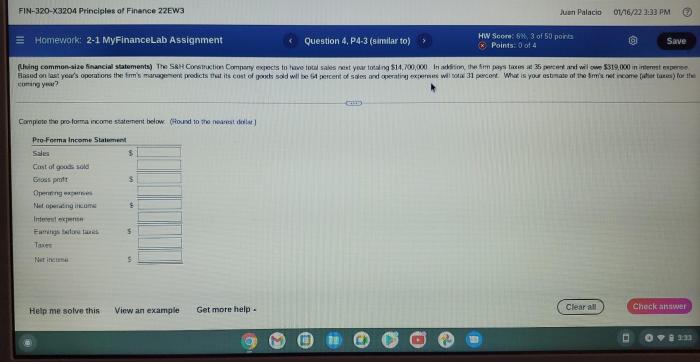

This authoritative guidebook offers a comprehensive exploration of the fundamental concepts of corporate finance, encompassing capital budgeting, cost of capital, capital structure, dividend policy, working capital management, financial forecasting and planning, financial statement analysis, mergers and acquisitions, and international corporate finance.

Each chapter delves into the intricacies of these key areas, providing a clear and structured framework for understanding the complexities of corporate financial decision-making.

1. Introduction to Corporate Finance

Corporate finance is the area of finance that deals with the sources of funding, and the capital structure of corporations, the actions that managers take to increase the value of the firm to the shareholders, and the tools and analysis used to allocate financial resources.

Corporate finance can also be defined as the application of financial tools and analysis to the problems of the business firm. The main goal of corporate finance is to maximize the value of the firm to the shareholders while considering the interests of other stakeholders.Essential

principles of corporate finance include:

- The time value of money

- The risk-return trade-off

- The efficient market hypothesis

- The capital budgeting process

- The cost of capital

- The capital structure

- The dividend policy

- The working capital management

- The financial forecasting and planning

- The financial statement analysis

- The mergers and acquisitions

- The international corporate finance

Financial managers play a vital role in corporate decision-making. They are responsible for making decisions about how to raise capital, how to invest capital, and how to manage the firm’s financial resources. Financial managers must have a strong understanding of financial principles and be able to apply them to the real world.

2. Capital Budgeting

Capital budgeting is the process of evaluating and selecting long-term investment projects. The goal of capital budgeting is to maximize the value of the firm to the shareholders.There are a number of different methods used for capital budgeting analysis, including:

- The payback period

- The net present value (NPV)

- The internal rate of return (IRR)

- The profitability index

The most common method used for capital budgeting analysis is the net present value (NPV) method. The NPV method takes into account the time value of money and the risk of the project.Companies evaluate and select investment projects based on a number of factors, including:

- The expected return on the project

- The risk of the project

- The size of the project

- The impact of the project on the firm’s financial statements

3. Cost of Capital

The cost of capital is the rate of return that a company must earn on its investments in order to maintain its current market value. The cost of capital is used to evaluate the cost of different sources of financing, such as debt and equity.There

are a number of different methods used to calculate the cost of capital, including:

- The weighted average cost of capital (WACC)

- The cost of debt

- The cost of equity

The most common method used to calculate the cost of capital is the weighted average cost of capital (WACC). The WACC takes into account the cost of debt and the cost of equity, as well as the proportion of each type of financing in the firm’s capital structure.Companies

determine their cost of capital by using a variety of methods, including:

- Using historical data

- Using market data

- Using a financial model

4. Capital Structure

Capital structure is the mix of debt and equity that a company uses to finance its operations. The capital structure of a company can have a significant impact on its financial risk and cost of capital.There are a number of different types of capital structures, including:

- Debt financing

- Equity financing

- Hybrid financing

Debt financing is the use of borrowed money to finance a company’s operations. Debt financing is typically less expensive than equity financing, but it also comes with more risk.Equity financing is the use of investor funds to finance a company’s operations.

Equity financing is typically more expensive than debt financing, but it also comes with less risk.Hybrid financing is a combination of debt and equity financing. Hybrid financing can be used to reduce the cost of capital and the financial risk of a company.Companies

manage their capital structure by using a variety of techniques, including:

- Issuing new debt

- Repurchasing debt

- Issuing new equity

- Repurchasing equity

Question Bank: Essentials Of Corporate Finance Stephen Ross Pdf

What is the main focus of Essentials of Corporate Finance by Stephen Ross?

Essentials of Corporate Finance by Stephen Ross provides a comprehensive overview of the fundamental principles and practices of corporate finance, encompassing capital budgeting, cost of capital, capital structure, dividend policy, working capital management, financial forecasting and planning, financial statement analysis, mergers and acquisitions, and international corporate finance.

Who is the target audience for Essentials of Corporate Finance by Stephen Ross?

Essentials of Corporate Finance by Stephen Ross is designed for students, practitioners, and anyone seeking to enhance their understanding of corporate finance. It is an invaluable resource for those seeking to develop a solid foundation in the principles and practices of financial management.

What are the key benefits of using Essentials of Corporate Finance by Stephen Ross?

Essentials of Corporate Finance by Stephen Ross offers several key benefits, including comprehensive coverage of essential corporate finance topics, clear and structured explanations, practical examples and case studies, and an authoritative tone that provides a deep understanding of the subject matter.